Next-Gen (Z) Entrepreneurs: Is the future of business getting younger?

We explore how this budding entrepreneurial generation is accelerating the shift, exploring the scale of Gen Z’s influence on UK business, and what they're doing differently to the rest.

Analysing Companies House data between the financial years of 2012/13 to 2024/25, we reveal the emergence of Gen Z directors and shareholders and their hotspots of business growth – such as where they operate, and which industries they operate in. We benchmarked the results against the overall business landscape to understand where this generation sits among the broader market.

Contents

How we did it

We analysed Companies House (external link) company incorporations data between the financial years of 2012/13 to 2024/25. It revealed that 3,978,666 businesses incorporated between these years were still active, and 4,635,160 were dissolved.

Due to such large numbers, we exported representative samples across both pools of data. Note that due to the data export date (November 2024), throughout this analysis the financial year of 2024/25 refers to 6th April 2024 to 1st November 2024:

- We exported 17,502 active companies as a sample. Within this we identified 1,419 active companies with at least one Generation Z director and/or shareholder

- We exported 20,199 dissolved companies as a sample. We identified 37 dissolved companies with at least one Generation Z director and/or shareholder

With these samples, we gathered insights around the emergence of Gen Z directors and shareholders to analyse the next generation. We examined shareholder ownership across each sample and identified up-and-coming Gen Z entrepreneur hotspots and trending trades.

Each sample result was scaled up using a multiplier to reflect the total number of active and dissolved company incorporations, with a 5% margin of error. The multiplier for active companies was 277.33, the multiplier for dissolved companies was 229.47.

Useful to know

In the UK, you can legally be appointed a company director from the age of 16, and anyone of any age can become a shareholder. At the time of publishing (2025), Gen Z are aged between ~13 and 28. This means 2012/13 was the first financial year a Gen Z director could legally be appointed (based on them turning 16 on the earliest possible date, 1st January 2013).

The rise of Gen Z directors and shareholders

Gen Z director appointments are growing on average 78% every year

The 2013/14 financial year saw the very first Gen Z director appointed. Our sample analysis estimates there were 1,109 appointments that year alone. Since then, the annual average the rate of appointments has been growing 78% excluding 2024/25, and 66% including it. That’s equivalent to 30,607 new directors each year excluding 2024/25, and 32,794 including it. Our sample analysis estimates today there’s currently 393,531 Gen Z directors with an active company.

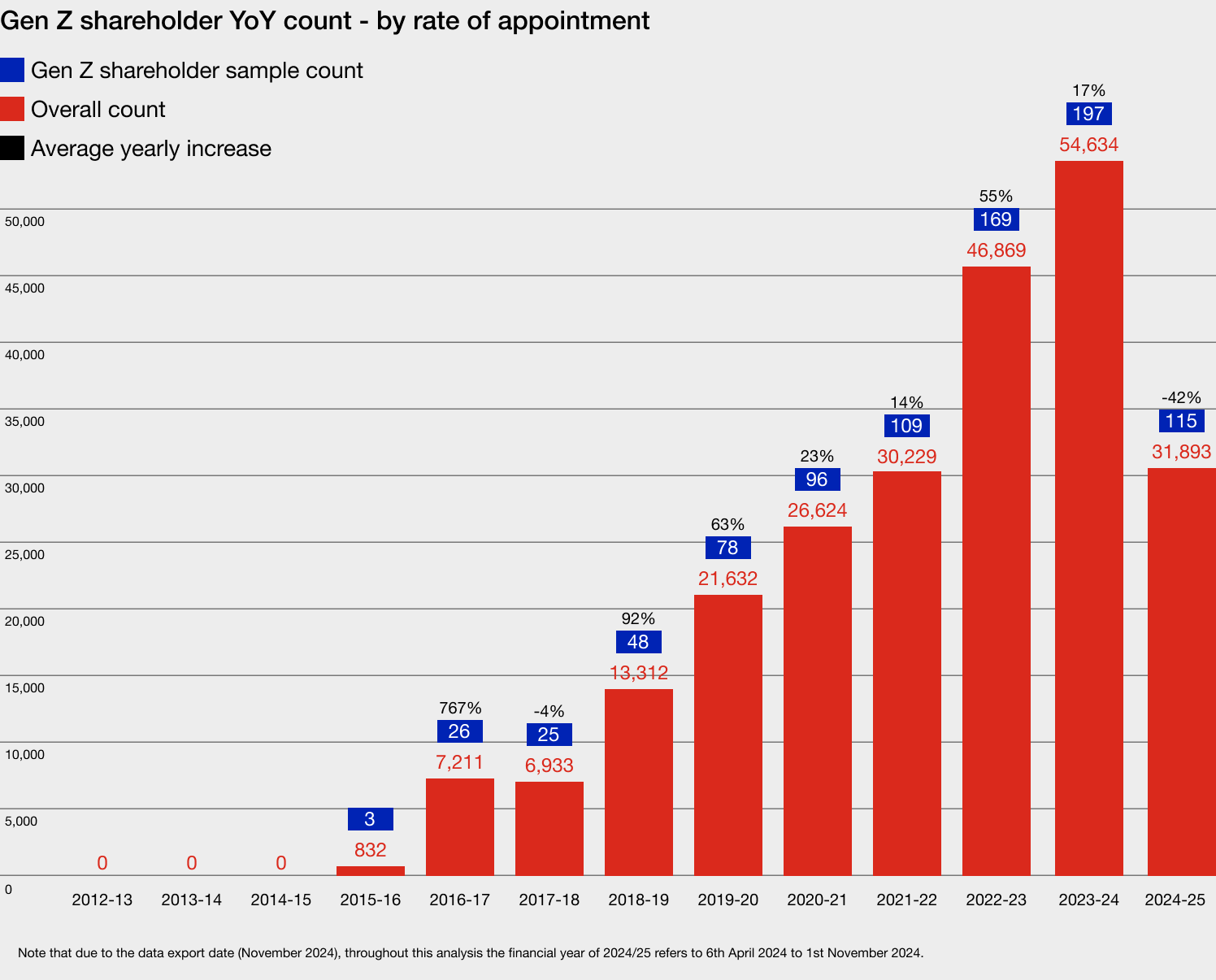

Gen Z shareholder appointments are growing on average 128% every year

Although there are no age restrictions on shareholders, the first documented Gen Z shareholder came later than the first director – in the 2015/16 financial year when 832 were appointed, according to our analysis. That number has grown by 128% annually excluding 2024/25, and 109% including it. That’s equivalent to 23,142 new shareholders each year excluding 2024/25, and 24,017 including it.

Nick Thornhill, Direct and Partnerships Director from Hiscox says: "We’ve long believed that entrepreneurial spirit knows no age. The meteoric rise of Gen Z entrepreneurs shows that the next generation is taking an active involvement in business - they’re turning bold ideas into business ventures and taking on influential roles.”

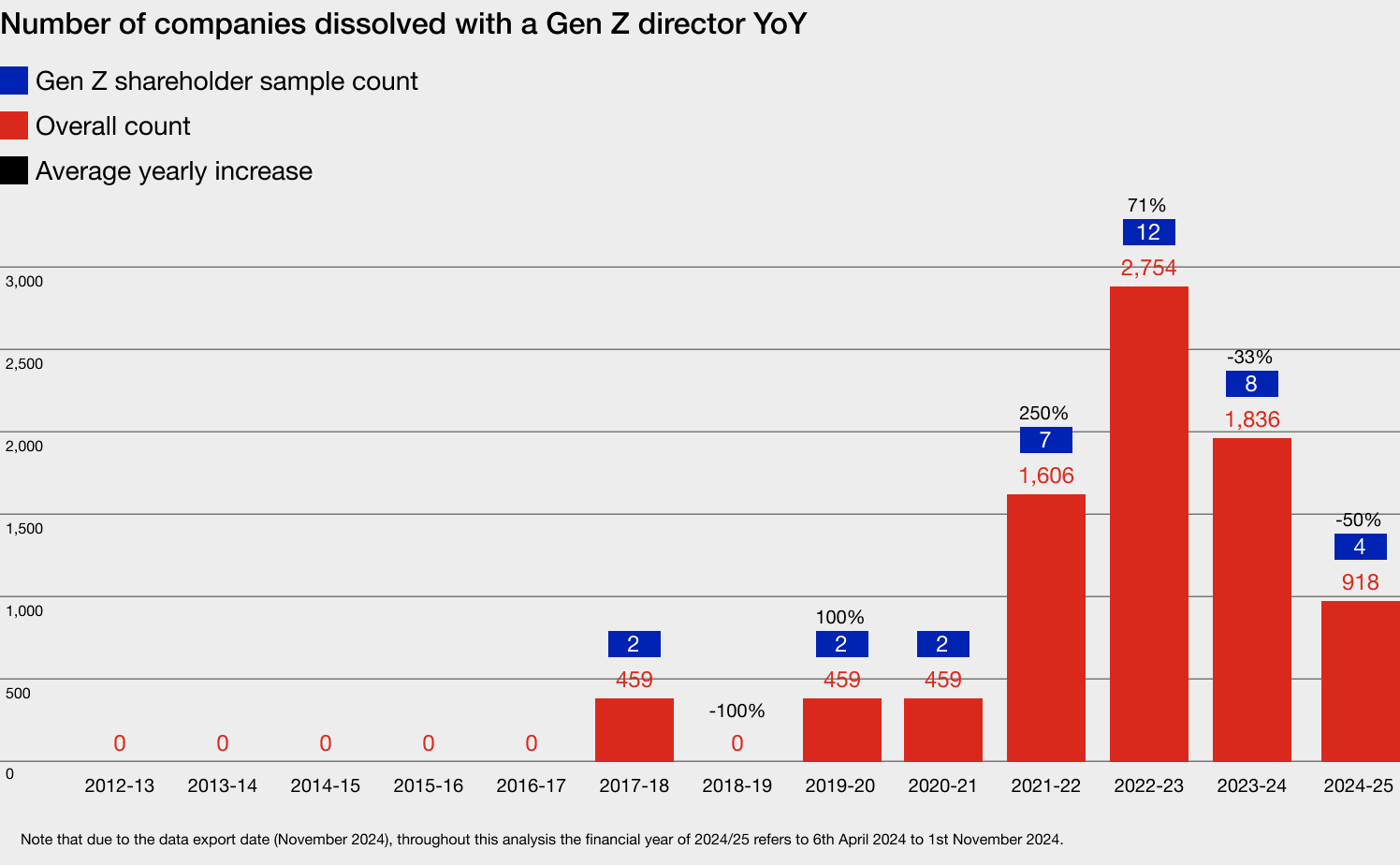

Gen Z business success rate

Unfortunately, not all businesses work out. Our sample only found 37 companies with a Gen Z director had closed in the last 14 years. That’s equivalent to 8,490 businesses when scaling up the sample. 2017/18 was the first year to see a Gen Z company dissolve, and since then, the average rate of dissolution has been growing 48% year on year excluding 2024/25, and 34% including it. However, it’s important to note that the small sample size disproportionately skews the average.

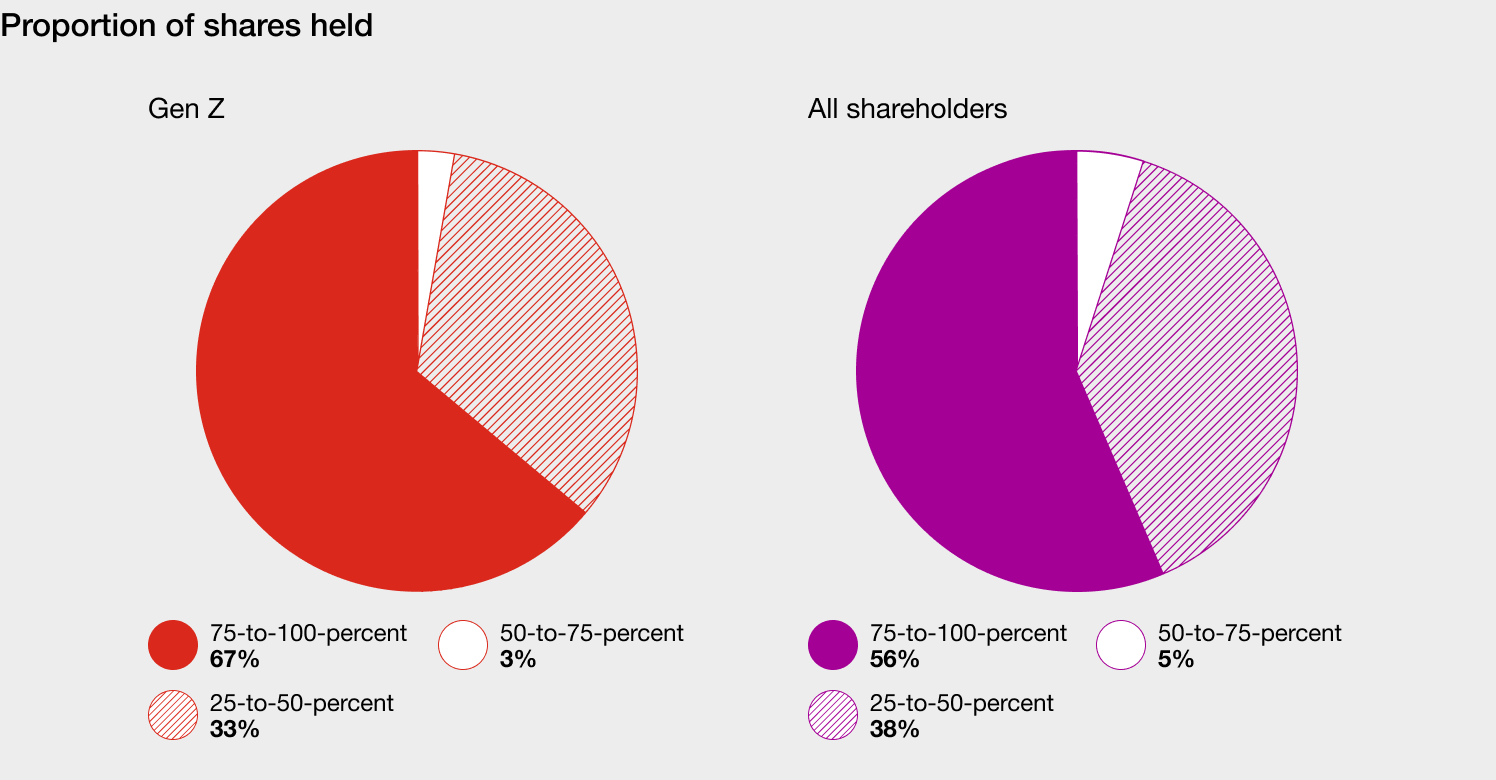

More Gen Z shareholders own a 75-100% stake of a business than the national average

Gen Z company ownership

We looked at the proportion of shares Gen Z own and compared this to the national average. Across all three analyses, most shareholders owned between 75-100% of a company’s shares. Though, more Gen Zs owned a majority stake compared to the UK average (67% compared to 56%).

Gen Z company hotspots

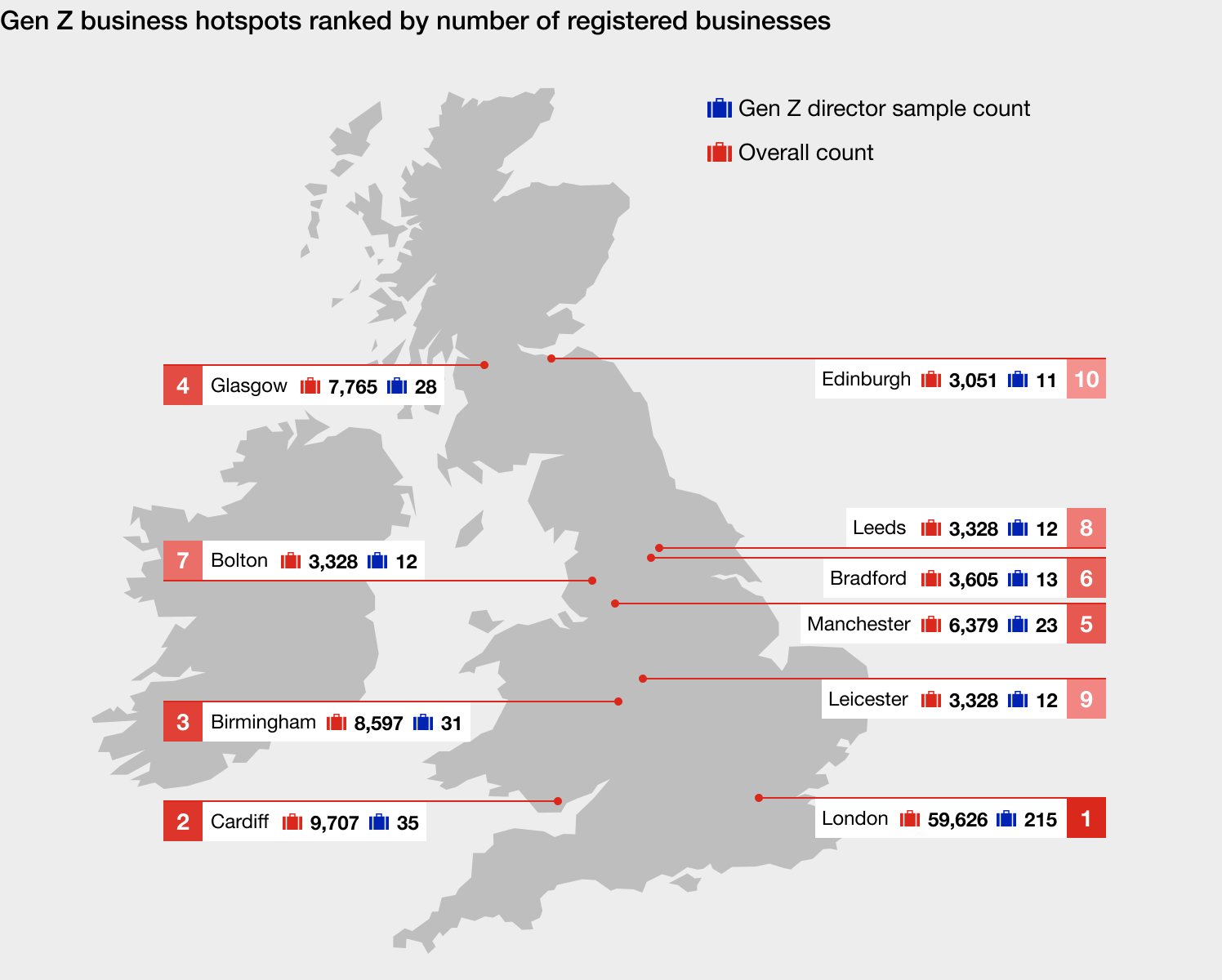

Britain’s Gen Z director hotspots

While it’s not a surprise that London ranked as the number one location for Gen Z directors (21% of all businesses with a Gen Z director), other cities – and one town – appeared. Wales’s capital city, Cardiff, ranked as the second largest hotspot of Gen Z directors, and Bolton, the only town to appear in the top 10, ranked sixth.

By comparison, when looking at all UK company incorporations, though London again ranks number one occupying a similar 19% share, Cardiff ranks fifth, and Bolton doesn’t appear in the top 10.

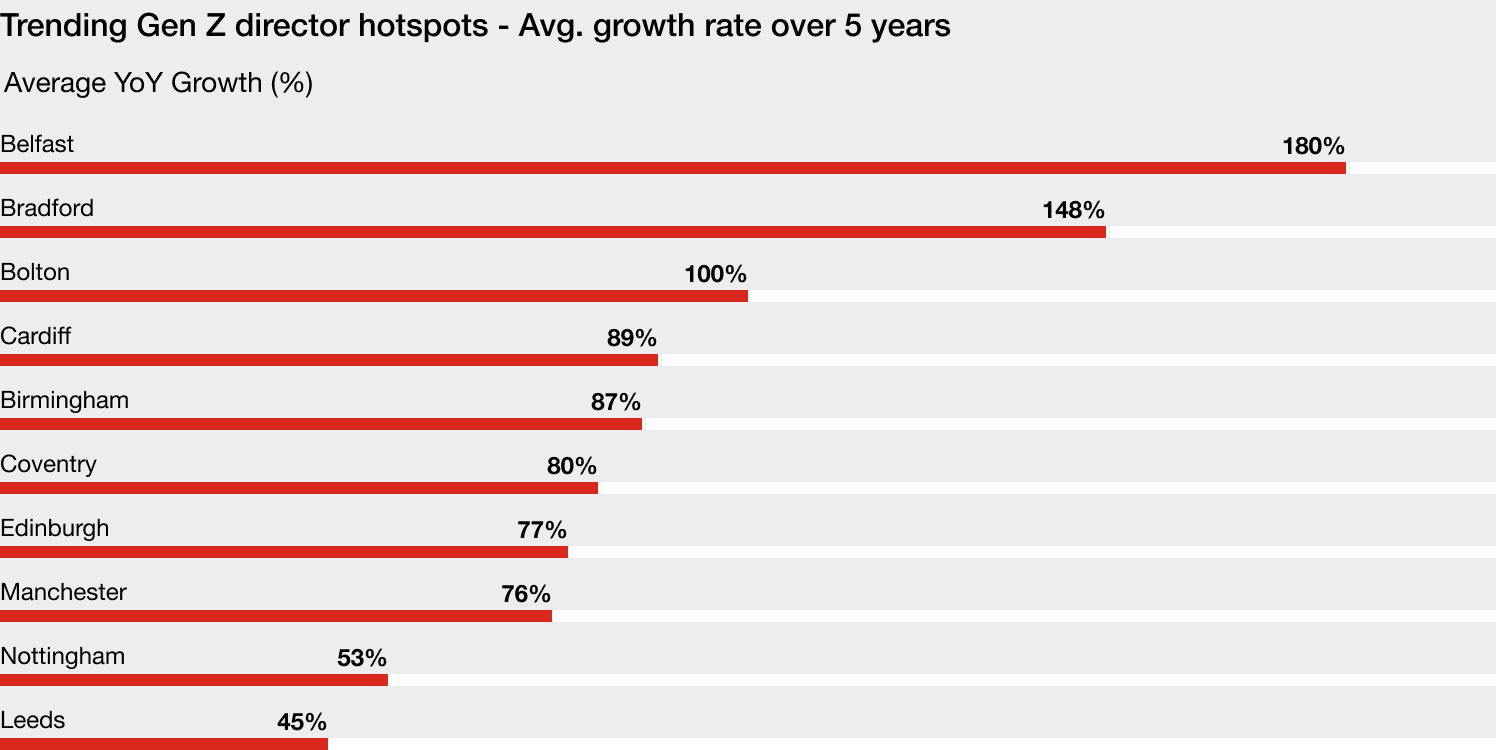

Belfast and Bradford show the highest rate of growth of Gen Z entrepreneurs

When looking at Gen Z director appointments over the past five years alone, London, on this occasion, didn’t cut the mustard. Belfast, Bradford and Bolton had the highest volume of average growth - as much as 180% for Belfast. These up-and-coming entrepreneurial hotspots shared the top 10 with some other cities, like Coventry and Nottingham.

By comparison, when looking at all UK business incorporations, regardless of their director, a growth analysis reveals Cardiff, Sheffield and Brighton were the biggest up-and-comers for new business.

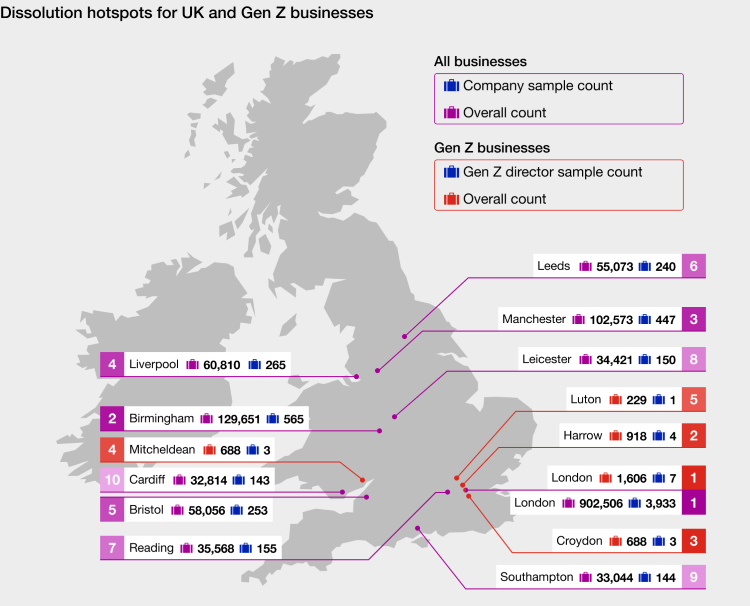

Company dissolution hotspots

London again found itself as a number one hotspot, however, for company closures this time. It was home to seven dissolved companies with a Gen Z director, which our analysis found was equivalent to 1,606 business closures. London accounted for 20% of all Gen Z business closures. Most locations only had one closure to their name.

Nationwide company closures echo London’s result as our sample found most dissolved businesses were in the capital, totalling as many as 902,506 closures according to our analysis. Like Gen Z, London was home to 19% of all UK company closures.

Eight of the top 10 hotspots for company incorporations also featured in this analysis, meaning though they’re hubs of entrepreneurship, they’re also hubs of business closures. Glasgow and Edinburgh, however, bucked that trend and didn’t rank as closure hotspots – Glasgow ranked as highly as the UK’s 2nd most entrepreneurial city.

Gen Z’s favourite business ventures

Gen Z online retail businesses are booming

Companies House provides a list of terms that can be used to describe a company's activities. The list is divided into 21 main industry categories, and within each category there are more specific trade activities.

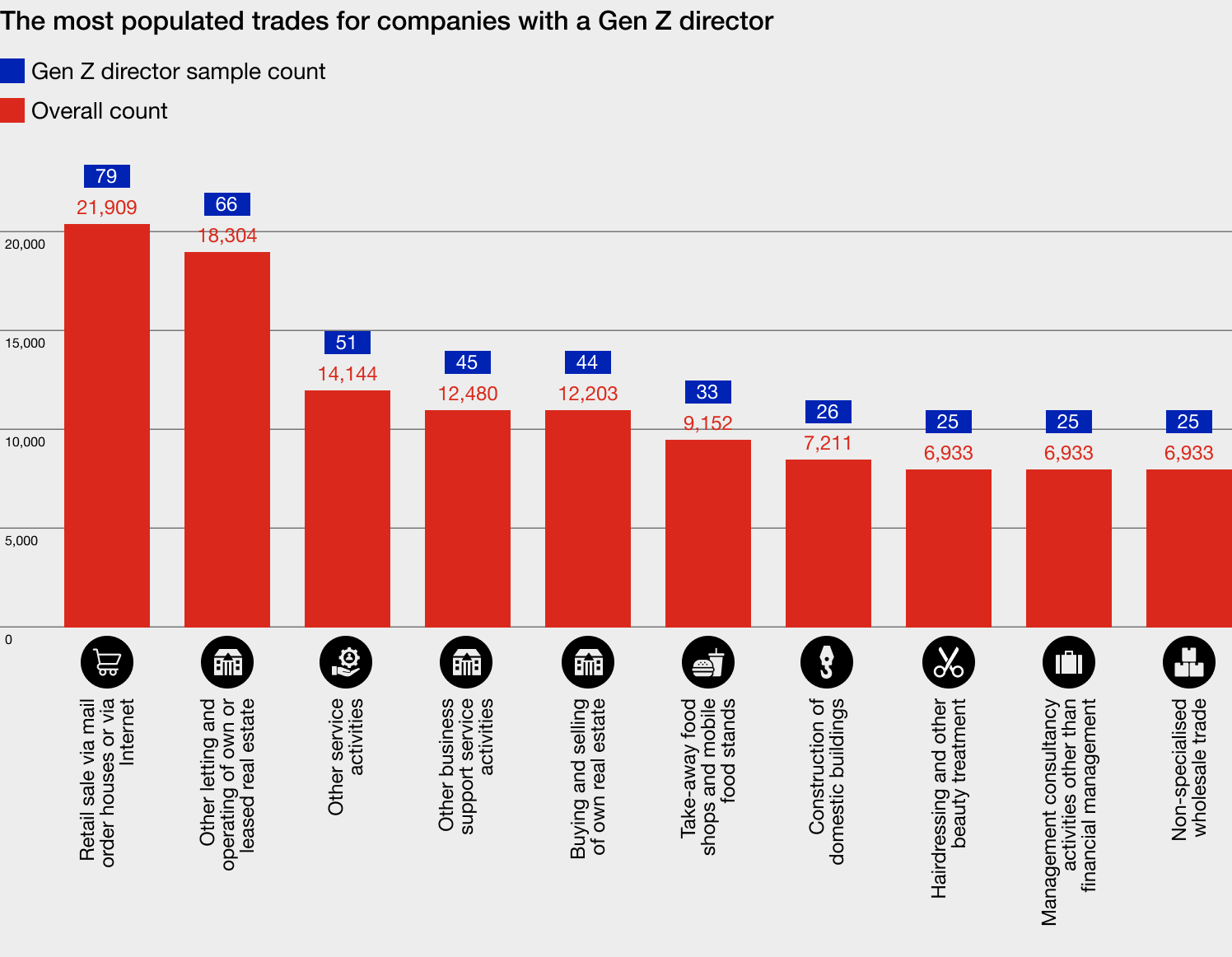

When investigating the specific kinds of businesses Gen Z directors are operating, online retail, real estate, and ‘other service activities’ emerged as the top three.

Retail sale via mail order or the internet can be a vast industry. These are online retailers shipping orders to customers who purchase goods like apparel, homeware, or even dog toys, for example. Our analysis estimates there are 17,205 of these businesses with a Gen Z director today.

Nick says: “After growing up more or less digitally native, it’s apt that Gen Z directors are most prevalent in an online industry. The internet has revolutionised retail, and with the emergence of e-commerce features on social media, there’s never been more digital avenues for retailers to sell products and services.”

We can also see parallels between this trade and trends that are popular on social media platforms with high Gen Z engagement, like TikTok. Drop shipping has trended for the past few years on TikTok, with various accounts touting it as an accessible business venture for young entrepreneurs. It’s a retail strategy where an online store sells products without owning the inventory. Instead, the retailer forwards the order on to their supplier who ships the product directly to the customer. When looking at terms like ‘drop shipping’, ‘drop shipping products’, and ‘drop shipping business’, they have 1.6M, 110K and 69K corresponding TikTok posts respectively.

Gen Z use property investment as an alternative to home ownership

‘Other letting and operating of own or leased real estate’ typically refers to companies that buy and hold property and rent it out. This type of activity accounted for 4.7% of all Gen Z businesses, which is notably higher than most other categories.

Our research estimates there are 18,304 Gen Z directors operating a company like this, which may be an unexpected result at first considering young peoples’ struggles getting on the property ladder. However, Robin Edwards, a property buying agent at Curetons (external link)says this is exactly why real estate ranks so highly:

“High property prices continue to make personal homeownership difficult, so many Gen Z investors see property investment as a different way to enter the market.

“Often these Gen Z investors rent and work in cities like London where it’s expensive to buy, so instead they invest in other regions of the UK with much cheaper property prices that offer better yields and more potential for capital growth. Often, they’re financed at least partially by 'the Bank of Mum and Dad' who are keen to help their children get on to the property ladder as soon as possible”

Another real estate activity also ranked fifth – ‘buying and selling of own real estate’.

Robin explains: “This can often refer to setting up companies for the trading and flipping of properties which are sold for a profit. It can also include land acquisition for development and speculative investments where properties are bought and held for value appreciation before resale.

“We’ve seen several young investors using this structure, often leveraging social media to document their progress and sometimes even attract funding. Many are inspired by property influencers who have made the idea of property investment cool and more accessible. However, rising prices, mortgage restrictions and regulatory changes present challenges. So, while real estate remains a popular wealth-building strategy, it's not always as straightforward as some may assume.”

Food and hair and beauty businesses are more popular among Gen Z than the rest of the nation

The top five trades with the highest concentration of Gen Z directors similarly appear in the UK’s top 10, but some differences emerge.

Takeaway food shops and mobile food stands (which ranked sixth), and hairdressing and other beauty treatments (which ranked eighth) were popular trades among Gen Z entrepreneurs, but not the rest of the nation.

Food stalls have been booming in popularity with new markets and vendors appearing across the country, which may be partly down to Gen Z according to the data.

TikTok has undoubtedly helped fuel this trend as terms like ‘food market’ have 29K posts, and ‘street food’ 1.7M posts. The platform is full of young creators exploring food markets and stalls, and demand for on-the-go market cuisine continues to grow. Google searches for the term ‘food stall’ are also up 8% in the past year according to Google Trends.

Social media is also just as important for hair and beauty businesses today. Many professionals take advantage of the visual nature of their work and social media to create an online portfolio of client consultations and ‘before and after’ results. ‘Hairdresser’ has 1.1M posts on TikTok and ‘hair transformation‘ – a trend where clients and hairdressers show a dramatic before and after hairstyle or colour – has a staggering 3.7M posts. ‘Beauty business’ and ‘beauty business owner’ also have 76K and 15K posts respectively.

Gen Z company closures

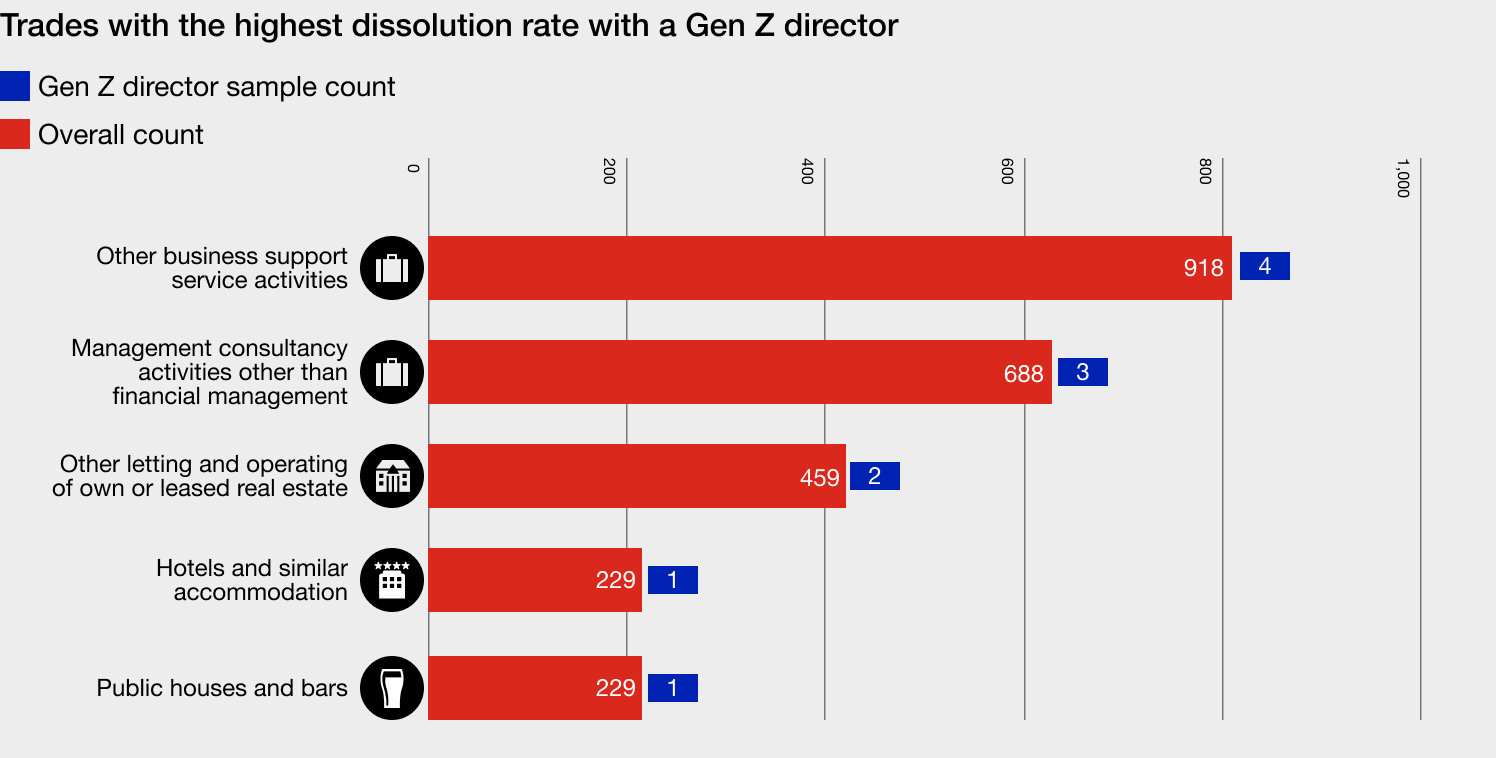

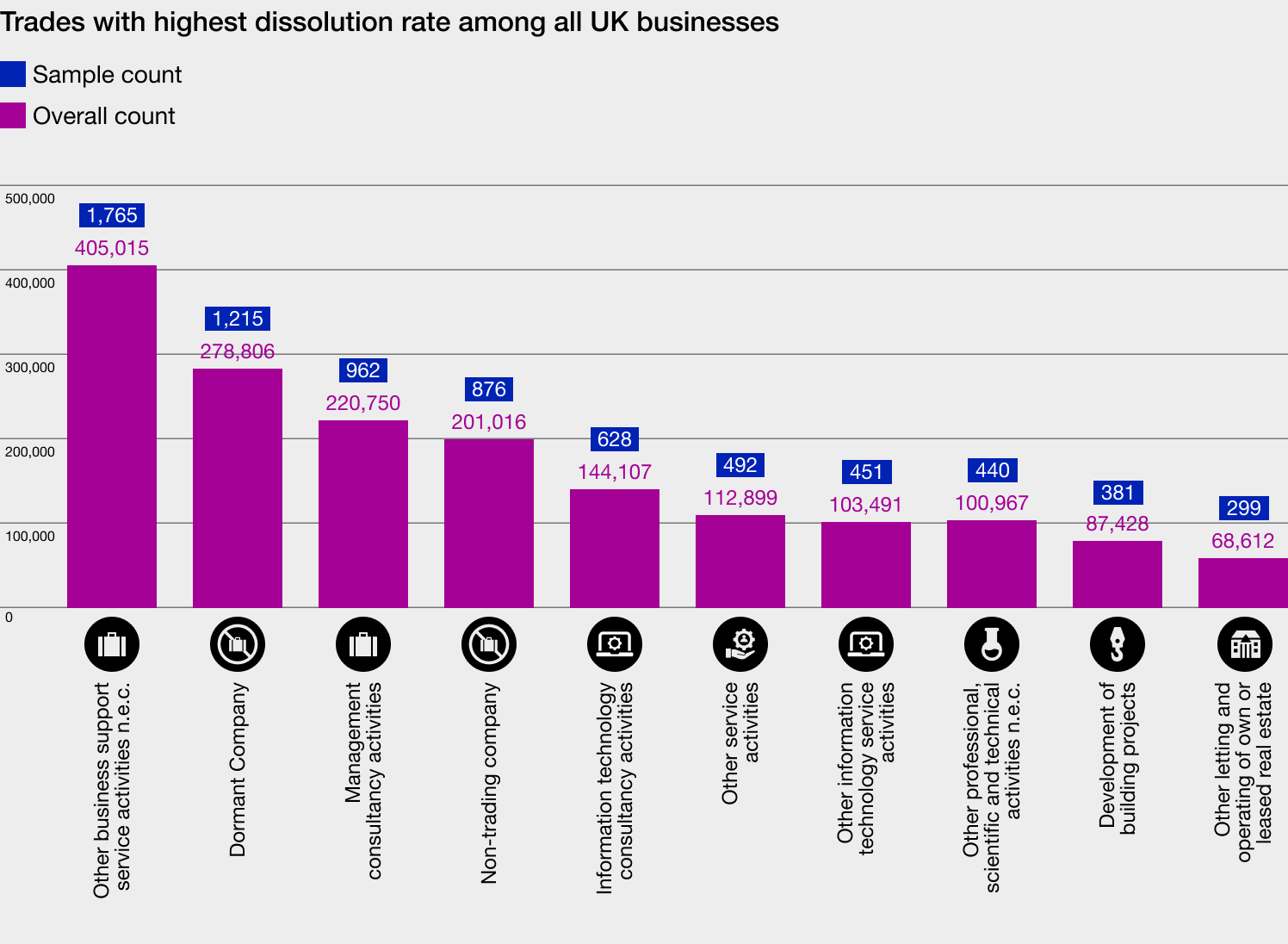

As very few Gen Z-run companies have dissolved, it’s somewhat arbitrary to identify which trades were most impacted. However, ‘other business support service activities’ saw the most closures according to our analysis, which estimates 918 of these businesses disappeared. This category is broad, but it can include court reporting, fundraising, auctioneering and gas, water and electricity meter reading. This result was mirrored in the nationwide results, ranking as the industry with the most closures – totalling an estimated 405,015 businesses.

‘Management consultancy activities other than financial management’ and ‘other letting and operating of own or leased real estate’ were the only two other categories to see more than one closure. Our figures estimate 668 and 459 Gen Z-run businesses respectively shut down since their incorporation. The former was also the third-most impacted trade nationwide as our analysis estimates 220,750 UK companies under this category closed, representing 5.6% of all closures.

Methodology

Please find our methodology under ‘how we did it’ here.

We sourced Google Trends and TikTok data on 04/03/2025.

The views of the people cited don’t reflect the views of Hiscox.

Hiscox is a specialist insurance company that offers a diverse range of business insurance products. Find information on our business insurance products, including public liability and professional indemnity.

Disclaimer:

At Hiscox, we want to help your small business thrive. Our blog has many articles you may find relevant and useful as your business grows. But these articles aren’t professional advice. So, to find out more on a subject we cover here, please seek professional assistance.