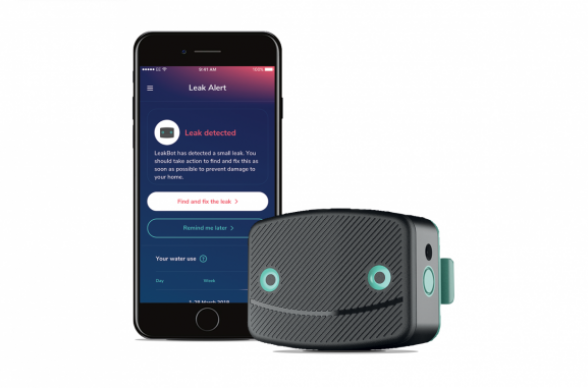

Introducing LeakBot

Free Leakbot (worth £149) for all buildings insurance customers

Damage caused by water leaks is one of the worst things to happen to your home. That’s why we are now offering all of our buildings insurance customers a free LeakBot and one engineer visit per year. LeakBot is a smart water leak detection device that alerts you to hidden water leaks early so that you can deal with them before they become a serious problem.