Starting a new business is a brave move for even the most qualified of entrepreneurs. The rewards can be life-changing if the concept has legs, and the potential for success is enormously inspiring. But in the temperamental world of business, no success is achieved without taking risks and overcoming obstacles.

With the constant development of emerging and evolving technology, and new start-ups cropping up every day, opportunity for innovation is as rife as competition is fierce.

So, are the risks worth taking in order to reap the rewards? We investigated further.

The biggest risks are taken in the first year of business

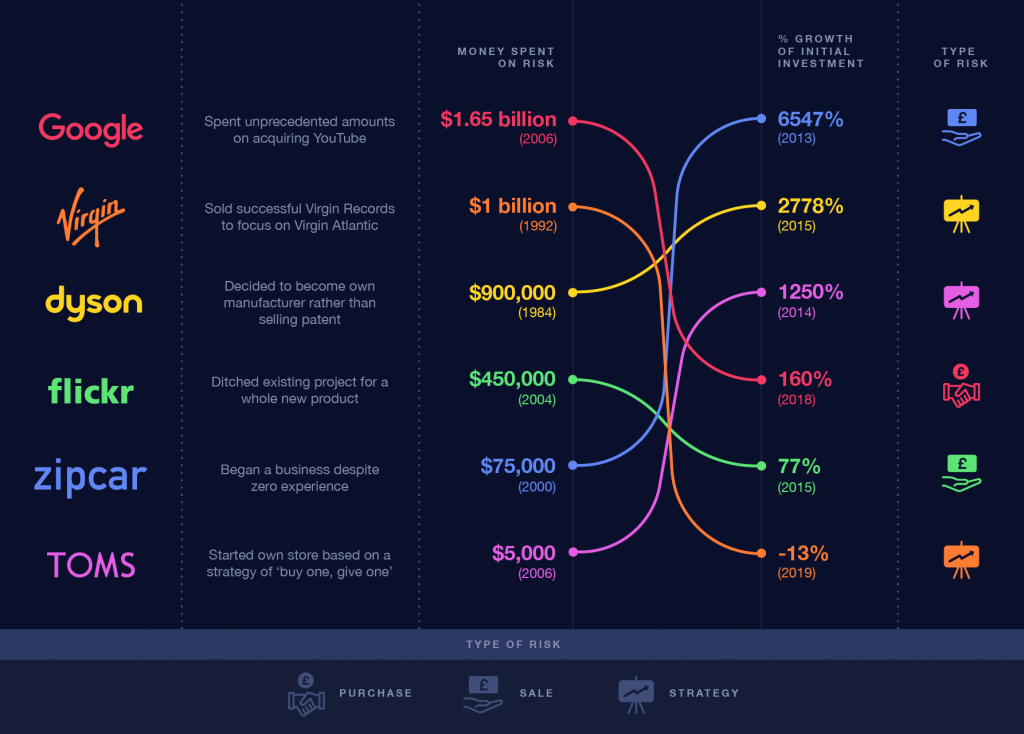

Looking at some of the biggest risk and reward stories across the business realm, we have identified six of the most common chances that entrepreneurs take when launching or growing their company.

The most significant and highest stake risks that a business will take usually occur in their first year of operation. It takes funding, a sound USP and a strong business model to get the start-up off the ground, followed by manpower and profit to excel growth. If one area fails, then it can have crucial implications for the future of the business.

Read on to find out more about the risks the world’s largest organisations took in their early phases, in order to get the where they are today.

Risk 1: Growth

Some of the world’s most recognised business success stories can be held accountable to the potentially crippling financial risks that they took to build the business and boost growth.

Firstly, without sufficient financial backing, a company’s prospect for profitability is small. While a lot of entrepreneurs turn to crowd-funding platforms (acquiring funding for a project by appealing for public donations – usually via the internet) to get money in the bank, a large portion of start-ups rely on bank loans and investments from external stakeholders.

Of course, if things go to plan, the business should generate enough income to cover the initial investments and beyond, however, if the gamble doesn’t pay off, the financial consequences can be hampering.

The same can be said for acquiring new assets. Whether done to drive growth, monopolise the market or expand the company’s offerings, mergers are good for business, but they can also come with unforeseen side effects and the ROI may prove uneconomical.

FinTech company, Ebury (external link), discovered that despite the challenges they faced in order to grow the business, it was the growth itself that proved the biggest risk. Hiscox have put together a case study documenting their rise to global success.

Example: Google

The risk: Acquiring YouTube for $1.65 billion in 2006

The reward: Google is now worth $132.1 billion – including a 160% growth on the initial YouTube investment

Google ranks third in the most valuable companies in the world of 2018[1], but it could have been an entirely different story if the astronomical £1.65 billion purchase of YouTube hadn’t proven to be the profitable investment they hoped for.

YouTube had only been around for a year or so at the time of the acquisition, but its videos were already being viewed by as many as a million people a day. While it hasn’t been quite as lucrative as Google may have hoped, YouTube continues to dominate the market and it could be argued that the purchase is worthwhile, even if purely to beat rivals such as Facebook to the acquisition.

Google make a point of not releasing the revenue and income of YouTube as a separate entity, however, it’s been estimated that it brings in over $10 billion annually and could be worth as much as $100 billion[2].

Risk 2: Cutting costs

In a similar vein to acquiring new business assets, sometimes selling on existing assets can be the most economic option – possibly because it’s costing the business too much to run or even if a desirable offer comes in, that simply can’t be turned down.

While this is a risky move, sometimes selling costly assets to focus money and resources on more profitable areas of the business can be a positive move for the progression of the company.

Example: Virgin Group

The risk: Selling Virgin Records for $1 billion to focus on Virgin Atlantic

The loss: Air France-KLM bought a 31% stake in Virgin Atlantic business leaving Virgin Group with a minority stake of just 20%[3].

Having founded Virgin Records in 1972, Branson successfully turned the label from a small successful record shop into a ground-breaker of the music industry, with some of the world’s hugest artists on the bill.

Entrepreneurialism simply runs through Branson’s veins, however, and by 1992 he struck a deal to sell the label for $1 billion to part-fund his new venture – Virgin Airlines. This was a mammoth sum at the time, and it helped to propel the Virgin Atlantic business into success.

In 2018, however, it was reported that Virgin Atlantic has made a loss of £28.4 million for 2017[4] and Air France KLM bought a 31% stake in the business worth £220 million, leaving Virgin Group with the minority stake (20%), while Delta retain 49%. Based on the price paid for the shares, you could estimate that the Virgin Atlantic business is worth approximately £709 million. This is significantly less than what Virgin Records sold for in 1992, and that’s not even accounting for inflation.

Risk 3: Strategy

It would be wrong to presume the risks taken by businesses are simply optimistic gambles. With so much on the line, realistically, every move is a calculated and very deliberate action. If a business isn’t meeting expectations in those early days, it’s critical that the reason(s) for the short-coming is identified and actioned strategically.

Sometimes a change of strategy is essential for the progression of the business, and in other cases altering the direction of the company altogether to suit market demand, or to navigate obstacles could be what it takes to achieve long-term success.

Perkbox (external link) changed their business model three times before finding success. Read what CEO, Saurav Copra, has to say about the challenges they overcame in a case study.

Example: Dyson

The risk: Borrowing $900,000 to start a manufacturing line instead of selling blueprint

The reward: The company is now worth $5.3 billion

Making the decision to start his own manufacturing company – rather than selling on the blueprint for the Dyson vacuum cleaner to an existing retailer – was the best career choice James Dyson ever made.

Having purchased what was allegedly the “most powerful vacuum cleaner on the market” (and subsequently finding that the product was far from efficient), Dyson resolved that he would create a new model that would blow the competing design out of the water. After five years of experimenting with prototypes, the vacuum cleaner was ready, but the anticipated demand from domestic appliance retailers simply wasn’t there.

At this point, he formulated a plan to open a manufacturing line himself – a business that required a $900,000 bank loan[5]. With hard work, determination and a strong sales pitch, he managed to get the Dyson vacuum cleaner into stores across the UK, and by 1996 it was the bestselling vacuum cleaner in Britain. Not long after, it went global.

Today, Dyson is worth an extraordinary $5.3 billion dollars and that $900,000 loan is old news.

Risk 4: Market demand

The starting point for any new business is identifying a gap in the market – because without a strong USP, the company is likely to get swallowed up among competition. For your own assurance, as well as stakeholders, every business leader should thoroughly assess the market demand (or how you could drive this demand) and build a full understanding of how your business could fit into the current landscape.

Introducing a fresh product to an existing market or creating a brand-new market altogether, gives the advantage of lesser market rivalry, however, the customers will need convincing that this innovation will benefit them in some way.

Smart energy company, geo (external link), took the plunge into launching a new piece of technology, into a basically untouched market. Hiscox has documented how they went on to become a market leader in a case study.

Example: TOMS

The risk: Creating a business model on the premise of giving away free stock

The reward: Sold 50% stake to Bain Capital Private Equity in 2014, valuing the company at $625 million[6].

When TOMS founder Blake Mycoskie hatched the concept for the “one for one” (for every pair of shoes purchased a pair is donated to a child in need) business model that the brand runs on, he didn’t have an easy time finding a shoemaker who would work with him. They all thought he was crazy, and the business would never have legs. Fortunately, he managed to convince a local shoemaker called Jose and the rest is history.

Upon launch of the brand, the press loved the TOMS story and within the first summer 10,000 pairs of shoes had been sold. The company went on to become more and more profitable and in 2014 private equity firm, Bain, took a 50% stake in the then valued $625 million business.

Unfortunately, four years on, TOMS’ earnings are down by a half as sales struggle and the company is facing approximately $350 million of debt, which analysts put down to the company not expanding their product-range enough[7].

Risk 5: Product demand

For a product to be profitable, it must provide the solution to an existing problem – if not, you’re opening yourself up for a tough ride convincing investors that it’s worth their money and customers that they want to buy it.

Example: flickr

The risk: Investing $450,000 into ditching their existing project for a new product

The reward: A 77% growth on initial investment

When Flickr founders Steward Butterfield and Caterina Fake founded the company, they originally intended for it to be a kind of a multiplayer online game, which eventually was turned into a chat system with live photo-sharing options. They later discovered that as the internet is ever changing, their product had to be too. Their users wanted to share photographs, not chat, so that’s the direction they took it in.

In 2005, Yahoo bought flickr for $25 million[8], from which the site rose in popularity among professional and amateur photographers. Unfortunately, it was still early in the growth of tech start-ups at the time and flickr likely missed out on what could have been a much larger buyout if they had held out for just a few more months, when the market took off – Myspace was sold to News Corp. for $580 million in July 2005 and YouTube was acquired by Google in October 2006 for $1.65 billion.

In 2018, after Yahoo’s acquisition by Verizon, flickr was sold on again to the independent image-hosting firm SmugMug.

Risk 6: Team

The beating heart of every successful business is a strong workforce, who share the same values and goals for the future and progression of the company. A lack of cooperation, or disagreements about key business activities can create roadblocks for maintaining successful growth.

Unfortunately, it’s not uncommon for a business to suffer as a result of personal fall-outs and breakdowns of relationships within the team. On top of this, every company with employees has to consider that they are responsible for their staff’s wellbeing. Employers’ liability insurance is a legal requirement, and can cover the business in the case an employee falls ill or is injured as a result of their work.

Unforeseen circumstances can’t be avoided, but it’s only sensible to take the time to confirm that everyone on board wants the same results before launching the business and you have the right cover in place to protect the business from costly legal fees.

Example: Zipcar

The risk: Starting a business with an unfamiliar partner, with just $68 in the bank

The reward: Zipcar was sold to Avis for $491 million, [9] 6547% the initial investment

For Zipcar founders, Antje Danielson and Robin Chase, the biggest risk of starting the company from nothing wasn’t purely the financial gamble, but also going into business with somebody they didn’t know all so well.

Launching Zipcar in 2000 with just $68 in the bank, a few short months after meeting, it wasn’t long before a rift grew between the pair. This led to Chase firing Danielson in 2001 over a dispute in a board meeting, before Chase was also fired after a fruitless round of funding in 2003.

Ironically, Zipcar went on to become a phenomenal success – it was sold to Avis in 2013 for a colossal $491 million,[10] 6547% the initial investment – but neither benefitted from the riches.

Conclusion

What’s evident from looking at each of the above companies’ stories, is that risk is an inevitable part of every business – nobody said success is easy! While chances still need to be taken to maintain growth and profitability after the business is fully established, it’s the high-stake risks in the early phases of a business that can present the most impactful rewards or obstacles.

Unsurprisingly, financial ventures carry the highest risk and reward potential. After all, money is a central factor in the motivation and operation of business. Other lesser considered risks, such as the humans behind the company’s running and changing market demands can also have a significant impact though.

Having a comprehensive business insurance policy in place can protect your business from many of the common risks faced in the day to day running, so you can have peace of mind and focus your attention on the positive sides of the business.

[1] https://www.forbes.com/sites/kurtbadenhausen/2018/05/23/the-worlds-most-valuable-brands-2018-by-the-numbers/#61276e3b2eed (external link)

[2] https://www.thestreet.com/investing/youtube-might-be-worth-over-100-billion-14586599 (external link)

[3] https://www.bbc.co.uk/news/business-40745277 (external link)

[4] https://www.ft.com/content/a81e071a-2847-11e8-b27e-cc62a39d57a0 (external link)

[5] https://www.inc.com/magazine/201203/burt-helm/how-i-did-it-james-dyson.html (external link)

[6] https://www.forbes.com/sites/clareoconnor/2014/08/20/bain-deal-makes-toms-shoes-founder-blake-mycoskie-a-300-million-man/#b69dd0556680 (external link)

[7] https://thehustle.co/toms-shoes-struggling/ (external link)

[8] https://www.theguardian.com/technology/2018/apr/23/flickr-bought-by-smugmug-yahoo-breakup (external link)

[9] https://www.theverge.com/2014/4/1/5553910/driven-how-zipcars-founders-built-and-lost-a-car-sharing-empire (external link)

[10] https://www.theverge.com/2014/4/1/5553910/driven-how-zipcars-founders-built-and-lost-a-car-sharing-empire (external link)

Disclaimer:

At Hiscox, we want to help your small business thrive. Our blog has many articles you may find relevant and useful as your business grows. But these articles aren’t professional advice. So, to find out more on a subject we cover here, please seek professional assistance.