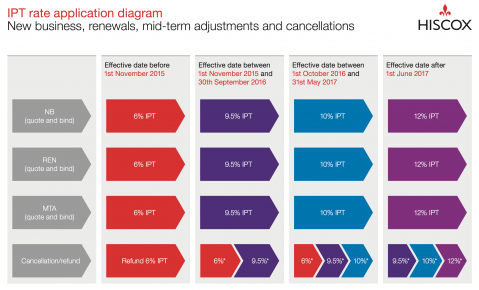

As announced in the 2016 Budget, the standard rate of Insurance Premium Tax (IPT) has increased from 10% to 12% from 1st June 2017.

The guide below details how the Tax changes for Hiscox policies must be applied under our agreement with you. Please read this.

New business, renewals, mid-term adjustments and cancellations

Key points to note

- The higher tax rate must be paid for transactions from the effective dates identified even if you do not collect it from the policyholder.

- If a quote was issued before 1st June and the policy is bound from 1st June onwards then 12% IPT will apply. You may therefore choose to advise prices for both IPT levels if you are not certain when the case will be bound.

If you have any questions regarding our above approach, please do not hesitate to contact your usual Hiscox Underwriting contact.