We believe in doing things a little differently, often covering risks that other companies find too complex or too much trouble.

Hiscox 606 Home Insurance has been designed specifically for owners of higher-value homes and possessions, with over £150,000 worth of contents (plus art and collections, jewellery, watches and valuable items).

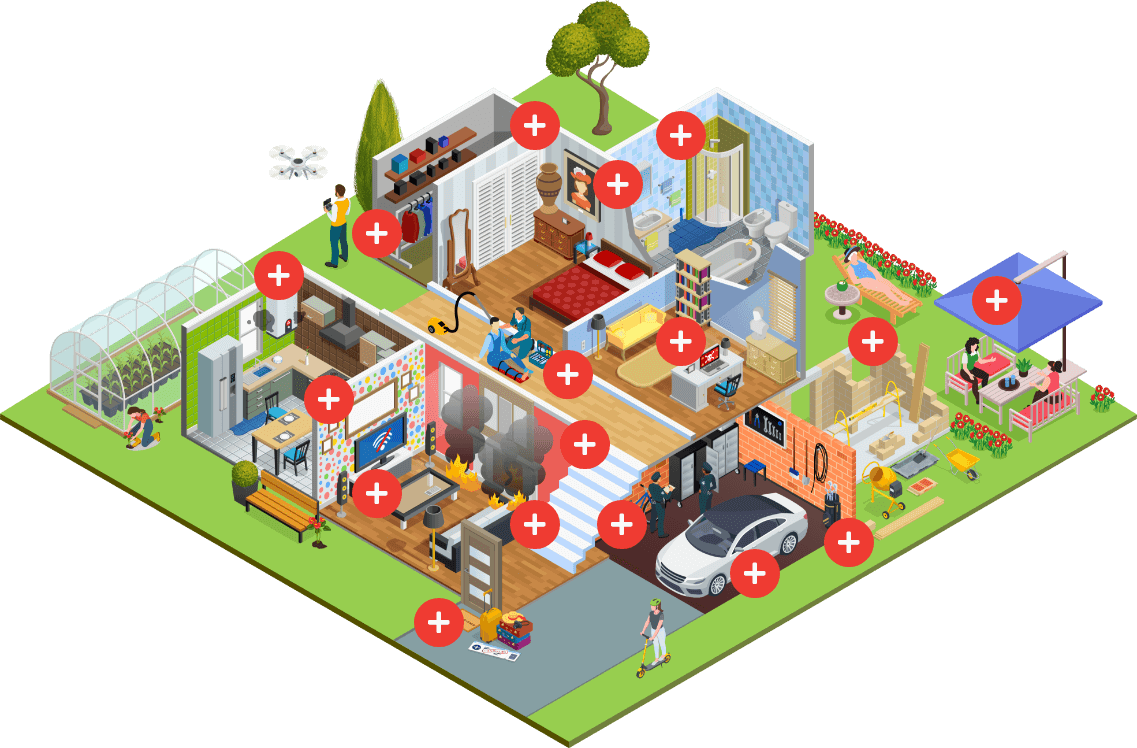

Hiscox 606 Home Insurance has always aimed to give you comprehensive cover and great service. And, as our customers’ lifestyles change, we continually look at how the cover can evolve to reflect those changes.

We have made some improvements to ensure we cover many of the new risks that have emerged following the Covid-19 pandemic – such as more people working from home, changing the way they commute, improving their homes, changing travel plans, ordering more online or becoming more aware of the increased threat from computer hackers.

Cover for your possessions on a ‘new-for-old’ basis with no

deductions for wear and tear,

wherever they are in the world, including accidental loss and

damage.

We offer a 25% increase (up to £100,000) on your contents, jewellery and art cover for any new acquisitions throughout the policy period — just make sure to tell us of the overall new sum insured at renewal.

You will need to tell us if you acquire any of the following during the policy:

It’s not just your possessions that are covered, we will also cover:

You can also choose to add personal cyber cover, worldwide annual family travel insurance, renovation and extension insurance, and motor insurance to your policy – giving you the ease of a single premium and policy to manage.

Hiscox Personal Cyber cover has been specifically designed to meet the needs of customers who wish to protect themselves against online threats to their personal computer network, hardware, IT and communication systems. Our simplified cover has a single £100,000 limit and can be added to your existing 606 policy for an additional annual premium of £95 (inc. IPT).

New and existing Hiscox 606 Home Insurance clients, who:

Subject to underwriting criteria. Speak to your insurance broker for more information.

From Brussels to Beijing. Wherever you are in the world, we’ll look after you with our annual family travel insurance extension, available as part of your Hiscox 606 Home Insurance policy for an additional annual premium of £300 (inc. IPT).

For new and existing Hiscox 606 Home Insurance clients insuring their main home with Hiscox.

Subject to underwriting criteria. Speak to your insurance broker for more information.

There is no need to notify us if contract works are under the value of £100,000. Existing structure and liability are already covered as standard within the Hiscox 606 Home Insurance policy, if buildings cover is included.

Subject to underwriting criteria. Speak to your insurance broker for more information.

Hiscox Motor Insurance has been designed for owners of higher-value cars and includes cover you won’t normally find within a standard car insurance policy. Our Hiscox Motor Insurance is available as a standalone product or can be added onto your Hiscox 606 Home Insurance policy – one policy, one renewal date, and one premium to manage.

Hiscox Motor Insurance is for people with two or more vehicles to insure, with one having a minimum retail value of £30,000 from new.

Subject to underwriting criteria. Speak to your insurance broker for more information.